|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Top Refinance Rates: A Comprehensive Guide for HomeownersRefinancing your home can be a great way to reduce your monthly mortgage payments or shorten your loan term. By securing the top refinance rates, you can potentially save thousands over the life of your loan. This guide will explore the current landscape of refinance rates, factors affecting them, and how to find the best options available. Understanding Refinance RatesRefinance rates are influenced by various factors, including market conditions, your credit score, and the loan-to-value ratio of your home. Being informed about these elements can help you secure the best refinance interest rates for your needs. Factors Influencing Refinance Rates

Steps to Secure the Best Refinance RatesFinding top refinance rates involves a bit of research and preparation. Here are some steps you can take: Evaluate Your Financial Situation

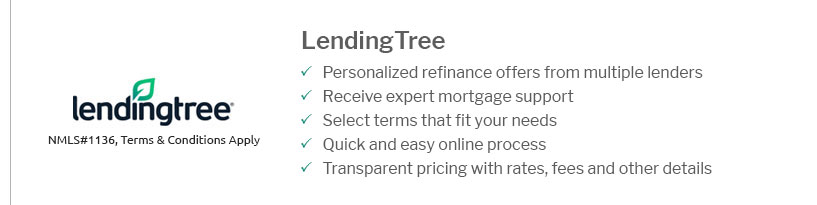

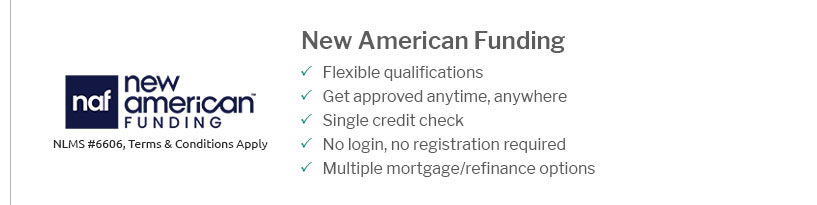

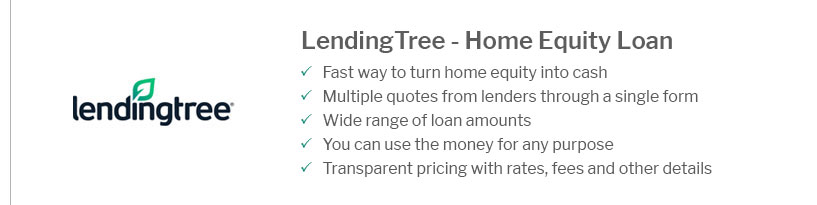

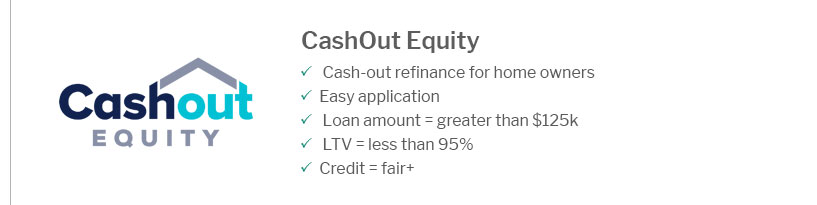

Compare Offers from Multiple LendersDon't settle for the first offer. Compare rates from different lenders, including those offering mobile home financing in Ohio, to ensure you get the best deal possible. FAQWhat is a good refinance rate?A good refinance rate is typically lower than your current mortgage rate. Rates vary based on credit score, loan type, and market conditions. Generally, a rate reduction of 0.5% or more could be beneficial. How can I lower my refinance rate?Improving your credit score, reducing your debt-to-income ratio, and opting for a shorter loan term are ways to secure a lower refinance rate. Shopping around and negotiating with lenders can also help. Is refinancing worth it?Refinancing can be worth it if the new rate significantly reduces your monthly payments or if you can pay off your loan faster. Consider the closing costs and whether you plan to stay in the home long enough to recoup these costs. By understanding refinance rates and taking strategic steps, you can make informed decisions to benefit your financial future. https://www.nerdwallet.com/mortgages/refinance-rates

The average APR on a 15-year fixed-rate mortgage fell 1 basis point to 5.948% and the average APR for a 5-year adjustable-rate mortgage (ARM) fell 3 basis ... https://www.cbsnews.com/news/what-are-todays-mortgage-and-mortgage-refinance-interest-rates/

15-year refinance: 5.98%; 30-year refinance: 6.70%. Find the best mortgage rates you can qualify for right now! How to get ... https://www.bankofamerica.com/mortgage/refinance-rates/

Today's competitive refinance rates ; 30-year - 6.750% - 6.950% ; 20-year - 6.625% - 6.863% ; 15-year - 5.875% - 6.165% ; 10y/6m - 6.875% - 7.164% ; 7y/6m - 6.625% - 7.069%.

|

|---|